Biden’s Multi-Trillion-Dollar Infrastructure Bill The Devil is in the Details

Written by Peter Boykin on April 3, 2021

Biden’s Multi-Trillion-Dollar Infrastructure Bill The Devil is in the Details

Biden will unveil his multi-trillion-dollar infrastructure bill

President Biden is headed to Pittsburg, PA to unveil his glutenous multi-trillion-dollar infrastructure plan. Depending on your source, the price tag will be somewhere between $2-4 TRILLION and will be coupled with tax increases.

Back up: Our country does need infrastructure investment. You might remember President Trump wanted a more modest $1 trillion dollar infrastructure bill that Democrats never got on board with.

Larry Kudlow warns this bill is “going to be less about traditional infrastructure and a lot more about the Green New Deal and a massive, across-the-board, tax hike.” [Kudlow was Trump’s economic advisor.]

Here’s where the money goes: [via CNBC]

$621 billion for transportation infrastructure

$300 billion into improving drinking-water infrastructure, expanding broadband access, and upgrading electric grids

$400 billion to care for elderly and disabled Americans

$300 billion for affordable housing, along with constructing and upgrading schools

$580 billion in American manufacturing, research and development, and job training efforts

The devil is in the details: At a glance, most of the spending above seems to make sense: transportation, electrical grid, 5G… Sounds good, right?. Until you dive deeper.

Buried in those brackets you’re going to find the following:

Subsidizing “clean energy” investments

Climate change funding

Free community college

Expanded childcare payments from the government

Paid family leave from the government

Child tax credits

Healthcare subsidies

Free and reduced tuition at historically black colleges & universities

…a massive expansion of the welfare state in America coupled with an investment in “social infrastructure” investments.

To pay for this, Biden wants to raise taxes:

The corporate tax rate will be raised from 21% to 28%.

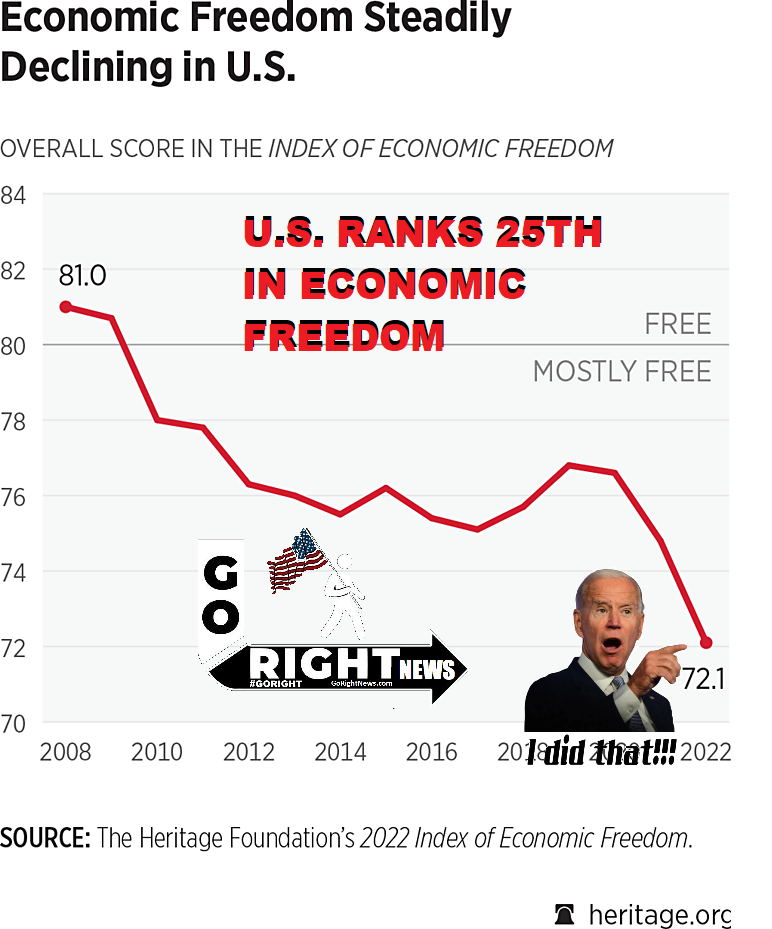

Remember: Trump lowered the corporate tax rate from 35% to 21%. This led to manufacturing coming back to the U.S. for the first time in decades and led to 2019 being the best economic year in the U.S. in decades.

Raising taxes on Americans.

Households making $400,000/year will see their tax rate jump to almost 40%.

Republicans in Congress aren’t totally against infrastructure spending, but they are against raising taxes and will likely oppose the bill because of it.

Luckily for Democrats, they don’t need a single Republican vote to pass this bill. They can use “budget reconciliation” to get around the 60 vote requirement in the Senate.

Budget reconciliation is a rule that allows Congress to pass bills with a simple majority when it has to do with budget and spending.

So our only hope in stopping this behemoth bill from becoming law is Republicans in Congress explaining to Americans that this is a bad bill. In other words… We’re screwed.

#MagaFirstNews a Part of https://GoRightNews.com

with Peter Boykin join him on

Telegram https://t.me/RealPeterBoykin

GAB https://gab.com/peterboykin

Podcast: https://www.spreaker.com/show/goright-with-peter-boykin

Check Out More Videos on

GAB: https://tv.gab.com/channel/peterboykin

Rumble: https://rumble.com/GoRightNews

Bitchute: https://bitchute.com/channel/gorightnews

Odysee: https://odysee.com/@PeterBoykin:2

Youtube: https://www.youtube.com/channel/UCbJq2br_Uw-tr3e4CIf5TAQ

Check Out Our Page on

Facebook https://www.facebook.com/GoRightNewsOfficial

Please Show Your Support by helping to cover the costs for these podcasts,

Donate directly at

Paypal: https://paypal.me/magafirstnews

BuyMeACoffee: https://www.buymeacoffee.com/PeterBoykin

Patreon: https://www.patreon.com/peterboykin

#GoRightNews